The long-term vision "Vision 2030" for the year 2030 as well as the medium-term management plan are posted here.

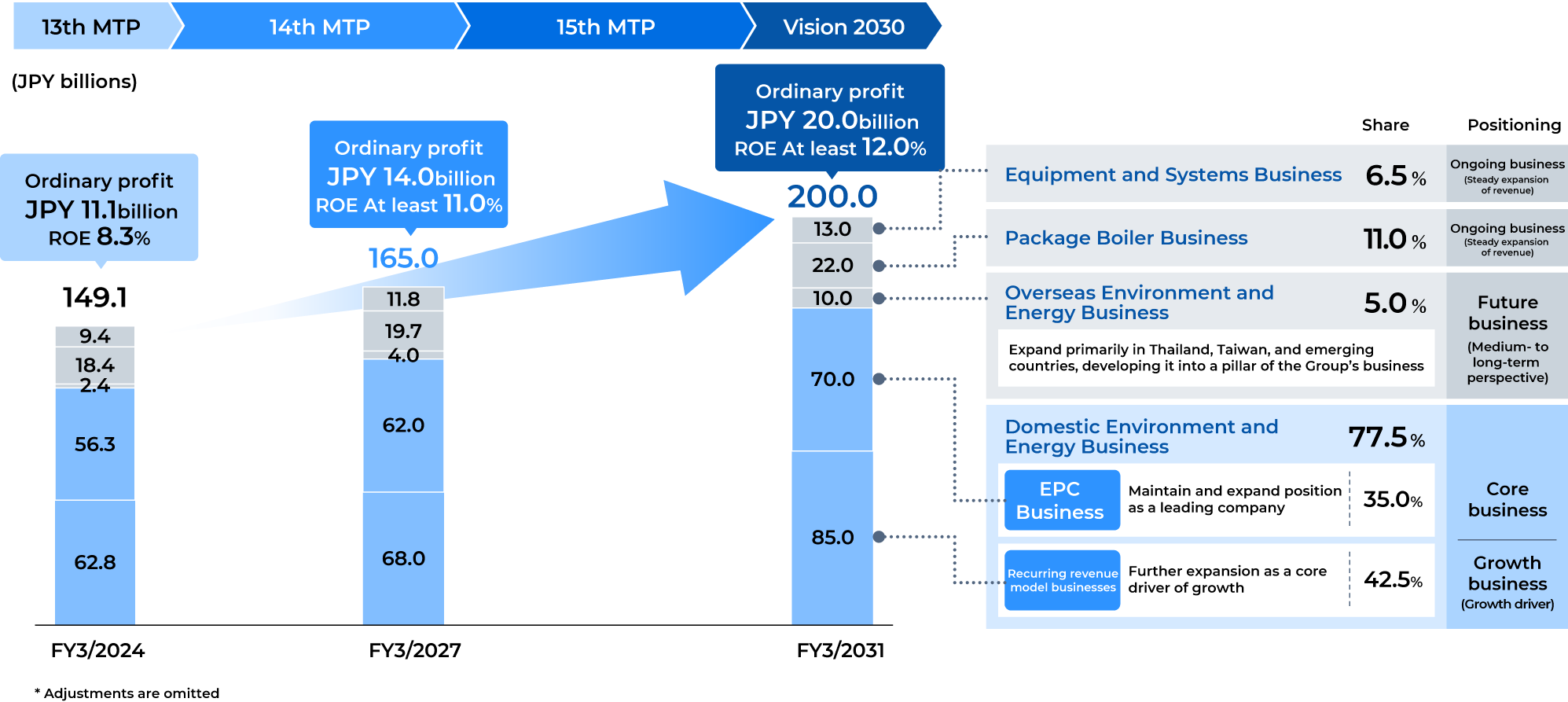

We aim to maintain our role of being an indispensable presence in society as a leading company in the field of renewable energy utilization and environmental protection and reach an ordinary profit level of JPY 20.0 billion.

A great partner to our customers

Innovation of technologies and services

Solving issues faced by our customers and society

As a leading company in the field of renewable energy utilization and environmental protection , we will help create a sustainable society.

Management Principles

Long-Term Vision

Medium-Term Management Plan

External Environment/Risks and Opportunities

Inputs

Financial Capital

Sound financial foundation

Intellectual Capital

Technologies and expertise in the field of renewable energy utilization and environmental protection

Human Capital

Personnel capable of addressing the needs and issues of customers and society

Social and Relationship Capital

Relationships of trust and co-creation with customers and business partners

Manufactured Capital

Construction of high-quality plants

Natural Capital

Efficient utilization of natural resources

Outputs

Highly trusted businesses in the environment and energy fields

Outcomes

Customers and local communities

Safeguarding hygienic living environments Maintaining regional and industrial infrastructure Revitalizing communities and strengthening resilience

Environment and society

Generating clean energy Reducing greenhouse gas emissions Reducing environmental footprint

Business partners

Ensuring fair and secure business transactions

Employees

Realizing highly motivating workplaces

Shareholders

Increasing corporate value

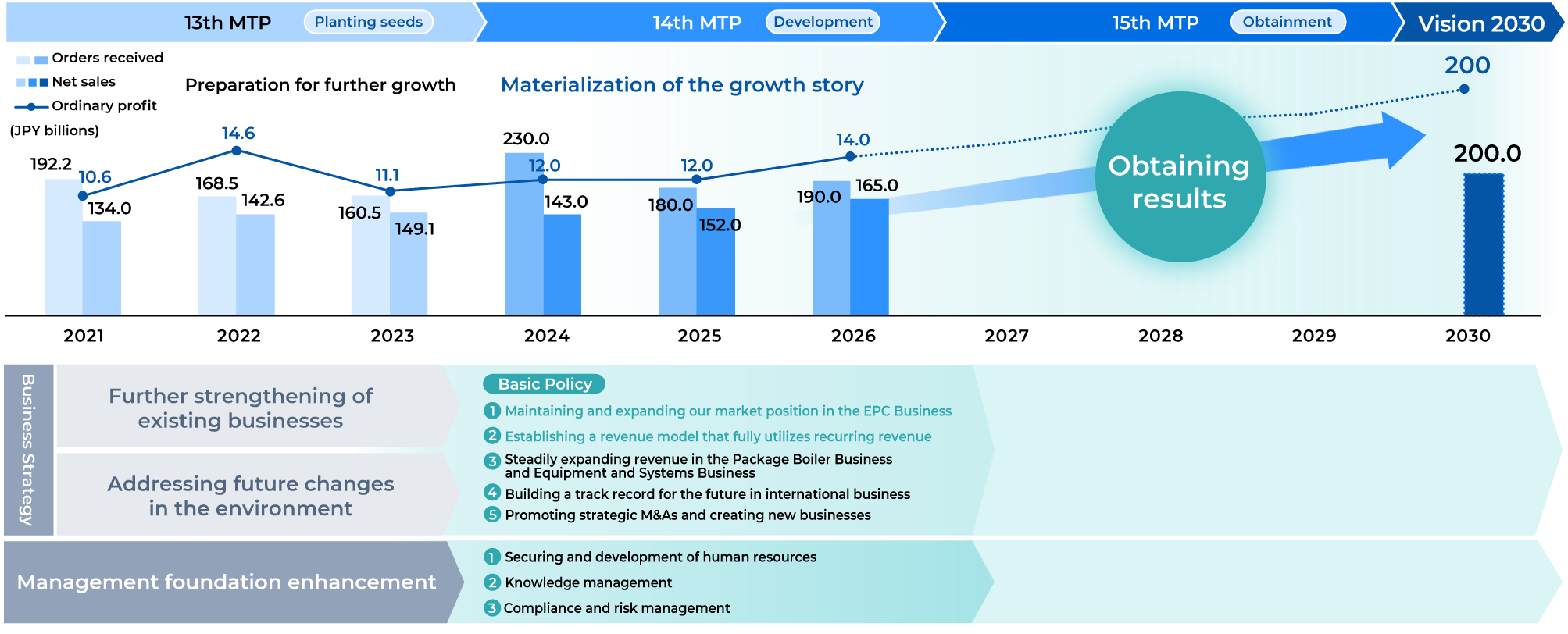

Achieve further expansion with recurring revenue model businesses as the core driver of growth for Vision2030. Work on expanding the EPC business at the same time as recurring revenue will increase to achieve ordinary profit of JPY 20.0 billion by FY3/2031.

Challenges for achieving Vision 2030 include a lack of resources. In the 13th Medium-Term Management Plan, we paved the way toward growth to resolve these challenges by assessing the business environment and strengthening recruitment. The 14th Medium-Term Management Plan is positioned to materialize the growth story for realizing the vision by prioritizing investment of management resources into receiving orders for municipal solid waste treatment plants (renewals and primary equipment improvement) and establishing a revenue model that maximizes the use of recurring revenue while formulating and implementing measures to solve various challenges.

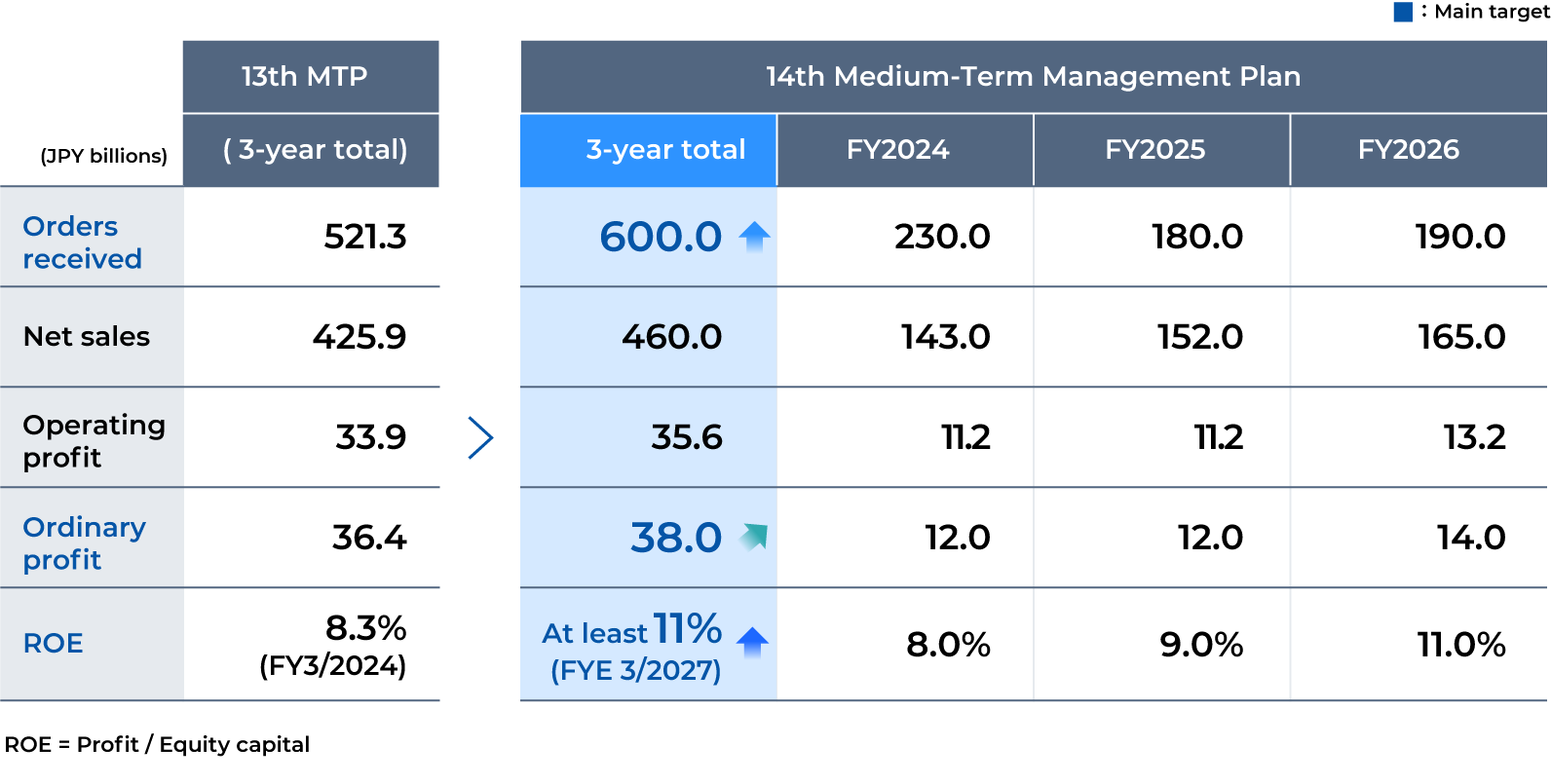

In addition to ordinary profit, new targets for orders received and return on equity (ROE) are set in the 14th Medium-Term Management Plan.

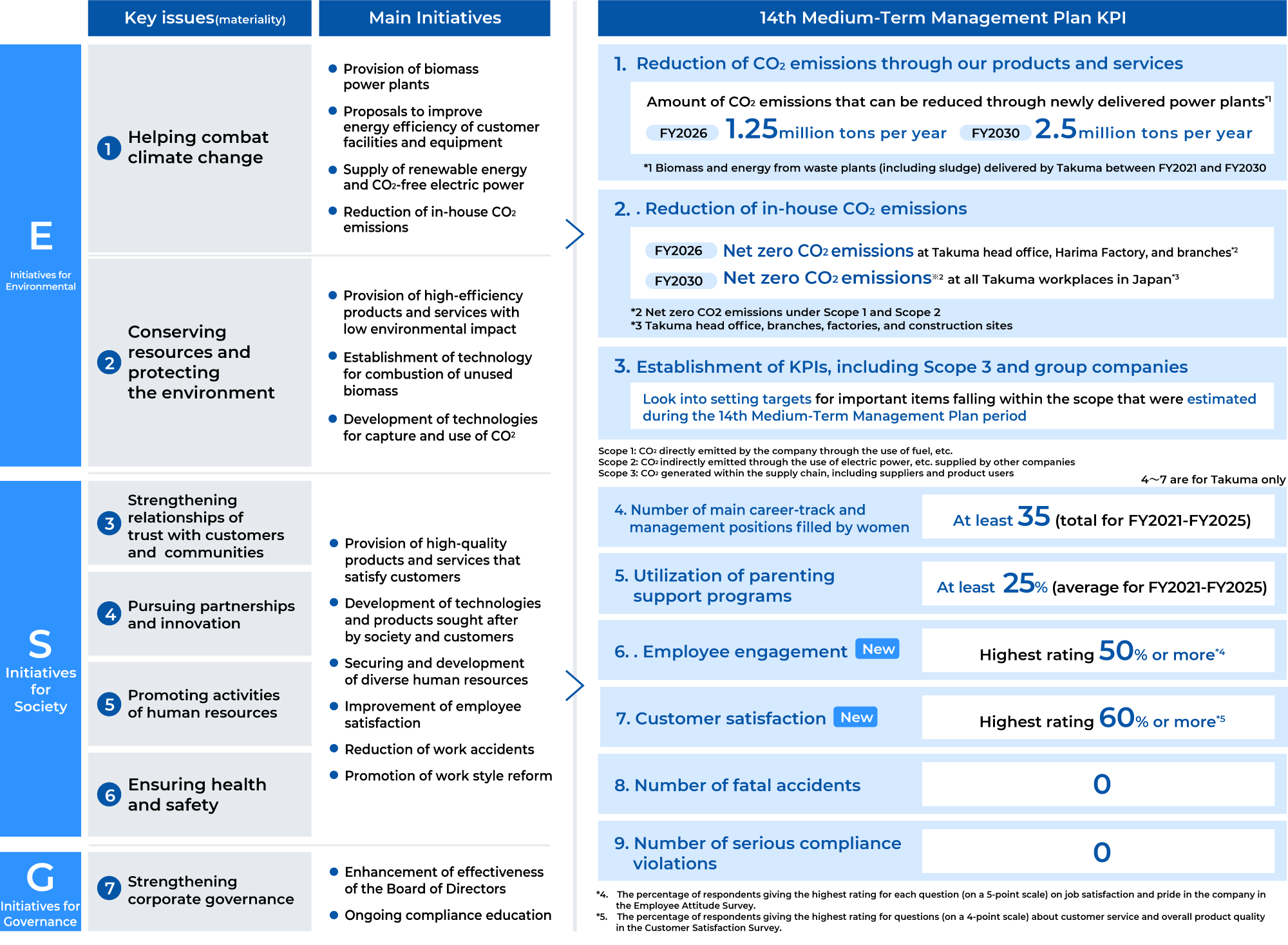

Continue to promote initiatives to address ESG issues through business activities by leveraging the Group’s strengths.

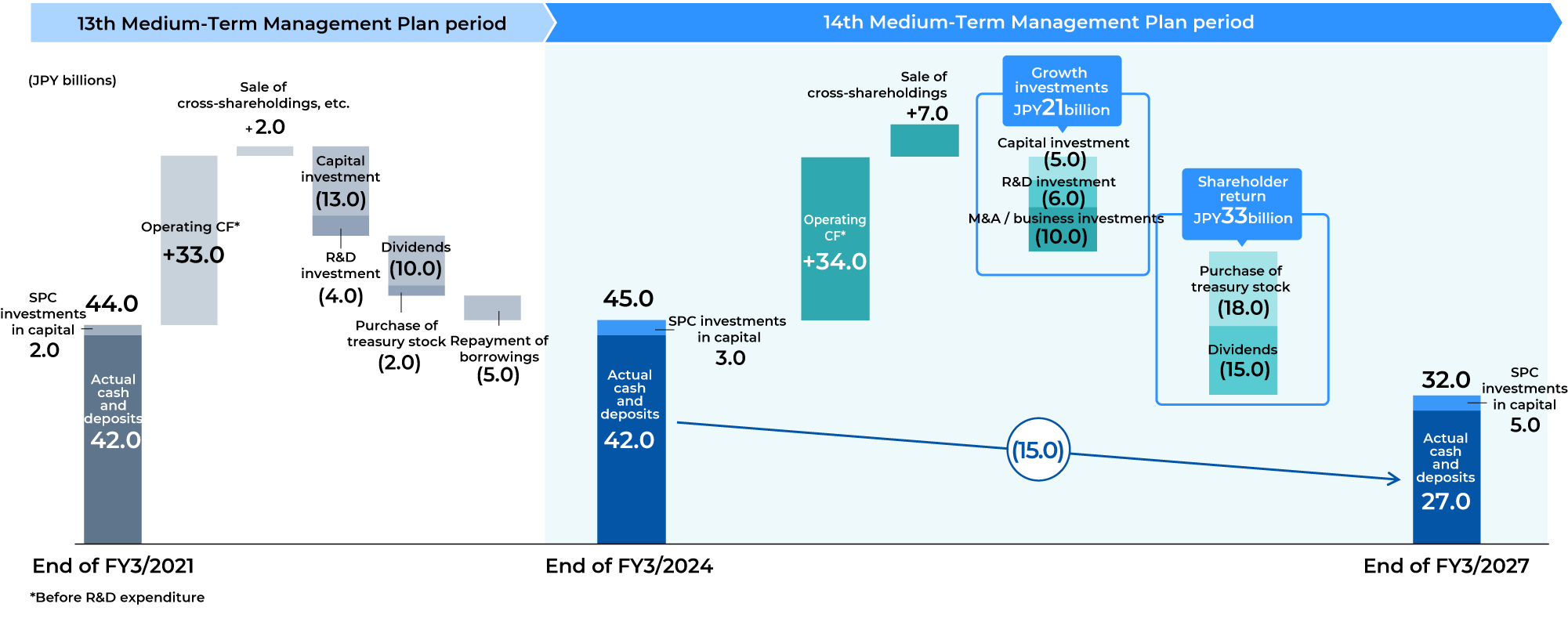

We will enhance corporate value by balancing business growth and shareholder returns that meet market expectations with a solid financial foundation.

01

Establish target ROE based on the recognition that the cost of equity over the past 10 years has been around 6%.

FY3/2027 ROE At least 11.5%

FY3/2021 ROE At least 12%

02

Secure a working capital and business risk buffer of roughly 2-3 months’ worth of sales (JPY 30-40 billion).

For cash and deposits above that level (operating CF + cash and balance in account), implement appropriate allocation between investment in growth and shareholder return.

03

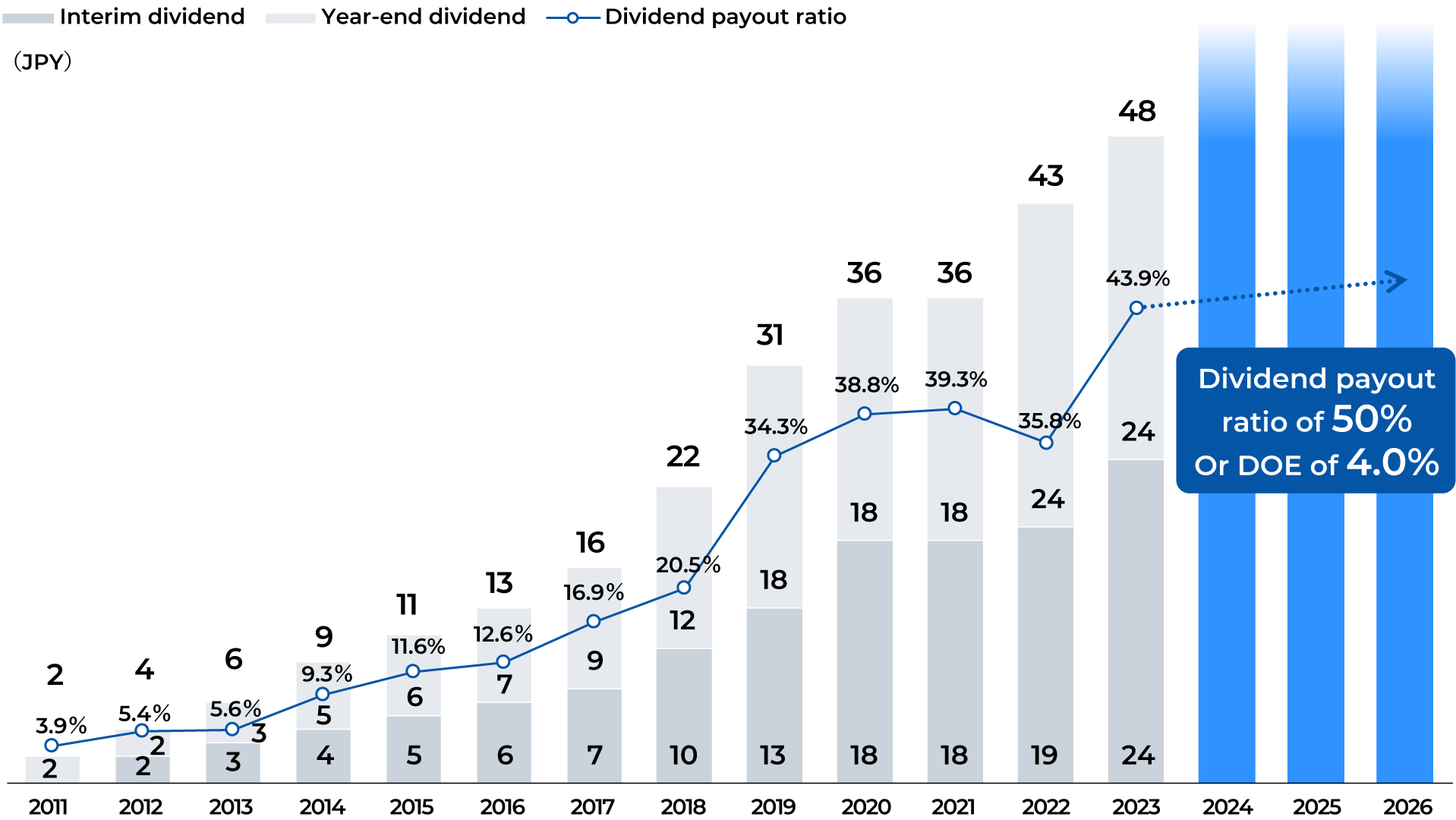

Establish as a target amount whichever is higher calculated based on dividend payout ratio of 50% or dividend on equity (DOE) ratio of 4.0%

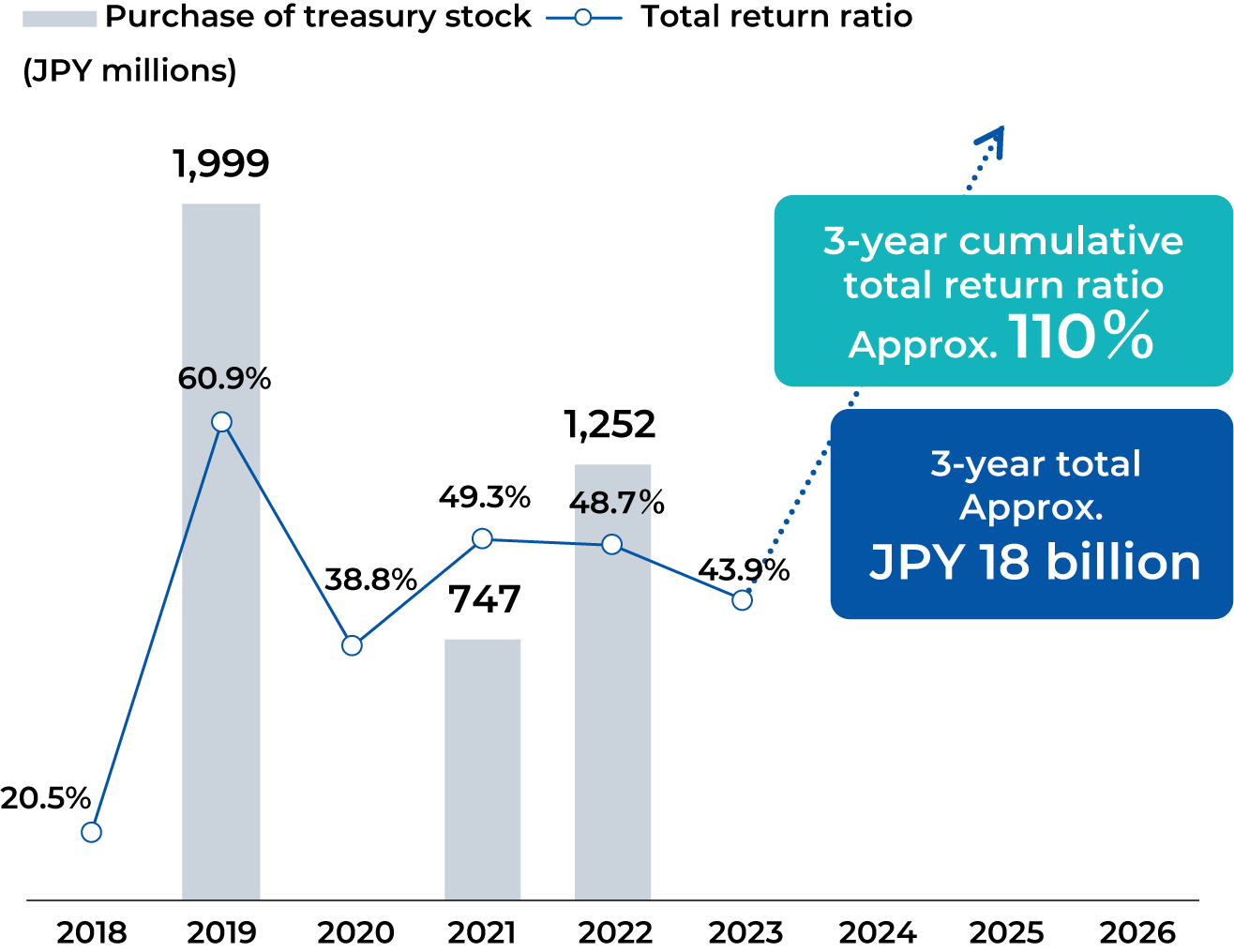

Share repurchase totaling approximately JPY 18 billion over three years to improve capital efficiency

04

Equity ratio Maintain at

50%level

Focus on growth investments and shareholder returns and execute appropriate cash allocation to increase corporate value.

01

21billion yen

02

35billion yen

01

Enhancing shareholder returns and improving capital efficiency through stable dividends and Purchase of treasury stocks

02

Establish as a target amount whichever is higher calculated based on dividend payout ratio of 50% or dividend on equity (DOE) ratio of 4.0%

03

Share repurchase totaling approximately JPY 18 billion over three years to improve capital efficiency