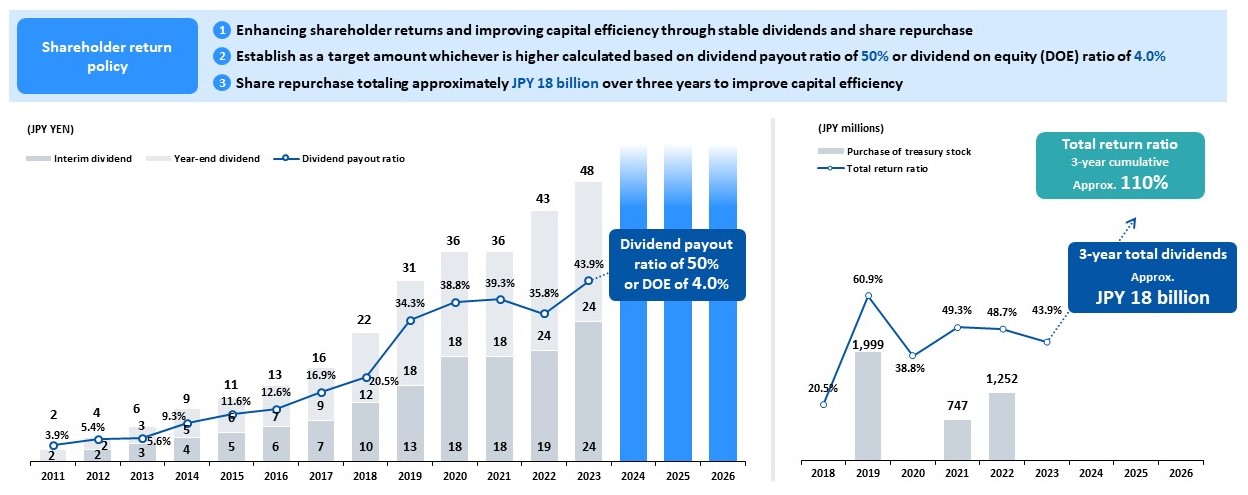

The 14th Medium-Term Management Plan, which began in April 2024, we have established the following new shareholder return policy.

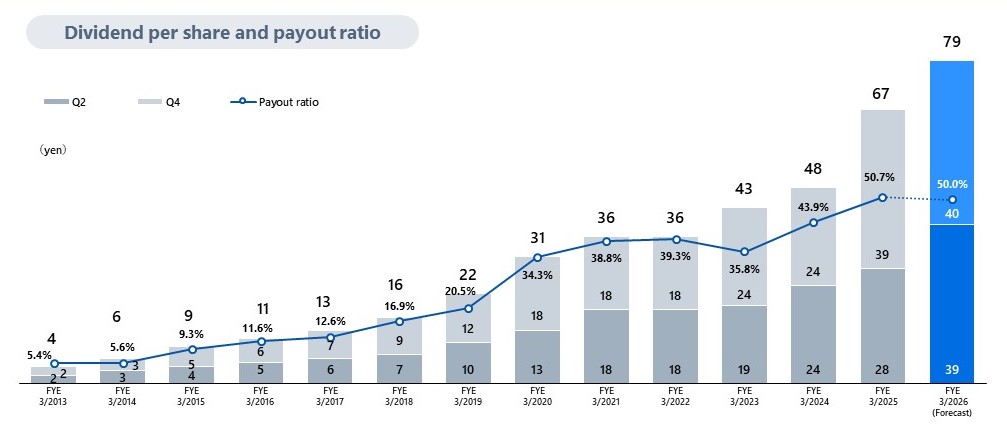

The annual dividend per share for FY2025 is expected to be 79 yen, a record high, representing an increase of 12 yen.

| FY2020 | FY2021 | FY2022 | FY2023 | FY2024 | FY2025 | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Annual dividend per share | FY2020 | 36.00 yen | FY2021 | 36.00 yen | FY2022 | 43.00 yen | FY2023 | 48.00 yen | FY2024 | 67.00 yen | FY2025 | 79.00 yen (forcast) |

| Interim dividend per share | FY2020 | 18.00 yen | FY2021 | 18.00 yen | FY2022 | 19.00 yen | FY2023 | 24.00 yen | FY2024 | 28.00 yen | FY2025 | 39.00 yen |

| Consolidated dividend payout ratio | FY2020 | 38.8% | FY2021 | 39.3% | FY2022 | 35.8% | FY2023 | 43.9% | FY2024 | 50.7% | FY2025 | - |

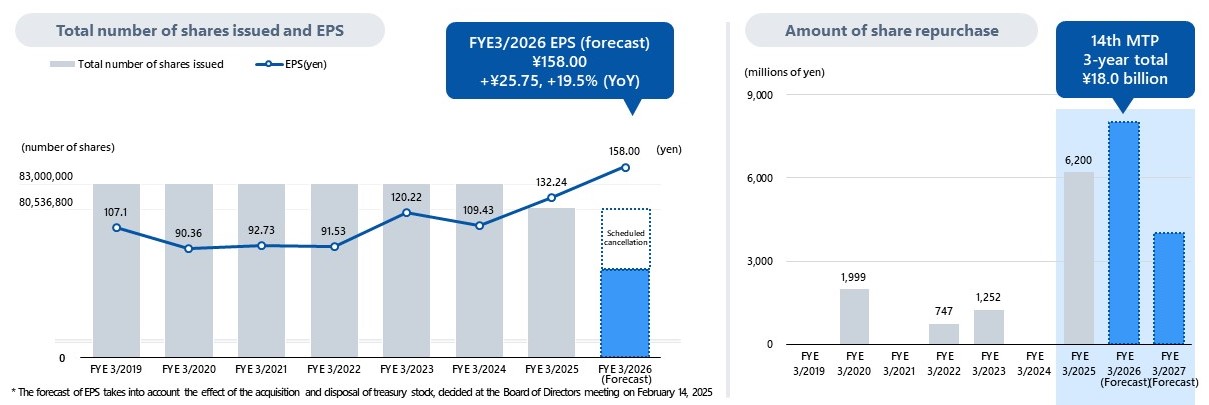

We plan to repurchase approximately 18 billion yen of treasury shares over the three-year period of the 14th Medium-Term Management Plan (FY2024-2026) in order to improve capital efficiency and enhance shareholder returns.

| Period of repurchase | Method of repurchase | Total number of shares to be repurchased | Total amount to be paid for repurchase |

| From February 17, 2025 to February 16, 2026 | Market purchase | 9,000,000 (maximum) | 10 billion yen (maximum) |

| From May 15, 2024 to January 15, 2025 | Market purchase | 2,463,200 | about 4 billion yen |

Currently, it is not adopted.