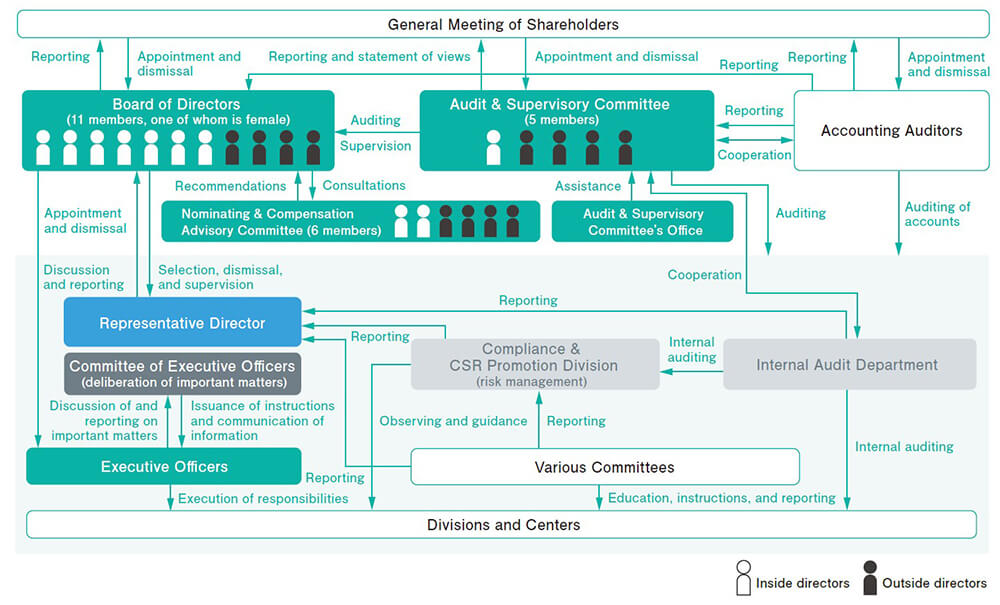

Through efforts to strengthen corporate governance, enhance risk management, and implement thorough compliance, the Takuma Group is working to build structures that make possible highly transparent and appropriate decision-making and to maximize its corporate value by assessing and managing risk in an appropriate manner and by preventing the cessation of business operations and loss of social trust from violations of laws and regulations.

In order to safeguard and steadily increase Takuma’s corporate value over the long term, it is essential not only to ensure the development of the company's businesses, but also to clearly define governance in corporate operations—that is, to ensure that shareholders' oversight of operations is carried out appropriately and that officers carry out their operational responsibilities by means of a process that is clear, rational, efficient, and legally compliant. For that reason, we strive to develop an internal control system based on the awareness that strengthening the Corporate Governance Code is a top-priority management issue. Similarly, we’ve formulated the Takuma Group Ethics Charter and the Takuma Group Code of Conduct in order to ensure awareness of the importance of compliance and made it available to all officers and employees while working to raise awareness and provide education on associated provisions. Furthermore, we've established an Internal Reporting System that consists of both internal and external helplines that serve as internal reporting hotlines. The Board of Directors oversees compliance with the Takuma Group Ethics Charter and the Takuma Group Code of Conduct through yearly reports related to these initiatives. In addition, the Audit & Supervisory Committee includes four outside directors who bring a high degree of independence to their roles, and we’re committed to continuously increasing Takuma’s corporate value by strengthening oversight of officers.

As of June 27, 2023

As of June 27, 2023, the Board of Directors was comprised of six directors (excluding directors who are members of the Audit & Supervisory Committee) and five directors (of whom four were outside directors). The Board of Directors meets regularly once a month as a rule and whenever else it is necessary to make decisions about important issues related to business management and issues established by law and ordinances, as well as to oversee the execution of the directors’ duties.

Directors: 11 (10 men and 1 woman), including 4 outside directors (3 men and 1 woman)

During FY2022, the Board of Directors complied with internal regulations concerning its discussion and reporting responsibilities by approving resolutions related to the Company’s basic policies concerning management, matters related to the execution of important operations, and matters designated by law and in the Company’s Articles of Incorporation; by reporting on important topics outlined in the medium-term management plan, including progress towards achieving KPIs related to the Key Issues (Materiality), initiatives to enhance human capital, initiatives to implement the digital transformation (DX), the general direction of Takuma’s M&A strategy, and R&D themes deemed likely to lead to medium- and long-term business growth; and by offering feedback on the contents of exchanges of views with investors in the context of Takuma’s IR activities.

In order to accelerate management decision-making and clarify where management responsibilities are placed, we have adopted an executive officer system in which we appoint executive officers who are entrusted with the responsibility of executing our business activities. As of June 27, 2023, there were 15 executive officers (including those who also serve as directors).

Moreover, we have also established a Committee of Executive officers, which is chaired by the president/chief executive officer, as an organization that deliberates matters that are brought up at meetings of the Board of Directors and other important issues related to the execution of our business activities. This committee communicates and provides direction about items decided by the Board of Directors and other important items related to the execution of our business activities appropriately to the divisions that are to execute them.

An Audit & Supervisory Committee that consists of five members, of whom four are outside directors, is responsible for accounting and operational audits. Members of the committee attend important meetings, including those of the Board of Directors and the Committee of Executive officers, and they strive to understand and observe the status of business execution in a timely and appropriate manner. Drawing on their professional background and experience, they express their opinions as necessary from an objective perspective, and they conduct strict auditing of the business execution performed by the directors. In addition, members of the Audit & Supervisory Committee work together to conduct audits of business sites, departments, and subsidiaries in line with audit policies and other guidelines while regularly exchanging information, including through reports on topics such as audit plans and audit status from independent auditors and the Internal Auditing Department. They also work to communicate effectively and share information with subsidiaries’ directors, auditors, and other personnel, and they receive business reports from subsidiaries as necessary.

During FY2022, the committee discussed topics including audit policies, audit plans, division of responsibilities, evaluation of the accounting auditor, development of a consensus on director appointment and remuneration proposals (except for directors who are members of the committee), and audit report drafts. It also identified the following as key audit items in the audit plan and pursued related activities:

In addition, the committee examined issues surrounding directors’ and executive officers’ execution of their responsibilities, for example by asking whether the key policies set forth in the medium-term management plan were being appropriately implemented and by reviewing the following:

Takuma has put in place structures to ensure Audit & Supervisory Committee members can do their jobs effectively by establishing an Audit & Supervisory Committee’s Office to help carry out the committee’s work.

We have established the Nominating & Compensation Advisory Committee to increase transparency and objectivity in the selection of candidates for director and executive officer positions and in the determination of the compensation and other terms so as to enhance the oversight function of the Board of Directors. The Committee includes a total of six members: four independent officers (independent outside directors), a representative director, and the executive officer in charge of human resources. The Nominating & Compensation Advisory Committee, which reports to the Board of Directors, discusses topics related to executive appointment, dismissal, and compensation as well as topics related to CEO succession planning. Having received those reports, the Board of Directors makes final decisions on related matters after sufficient discussion while respecting the Committee’s report.

During FY2022, the committee deliberated the following topics and reported to the Board of Directors:

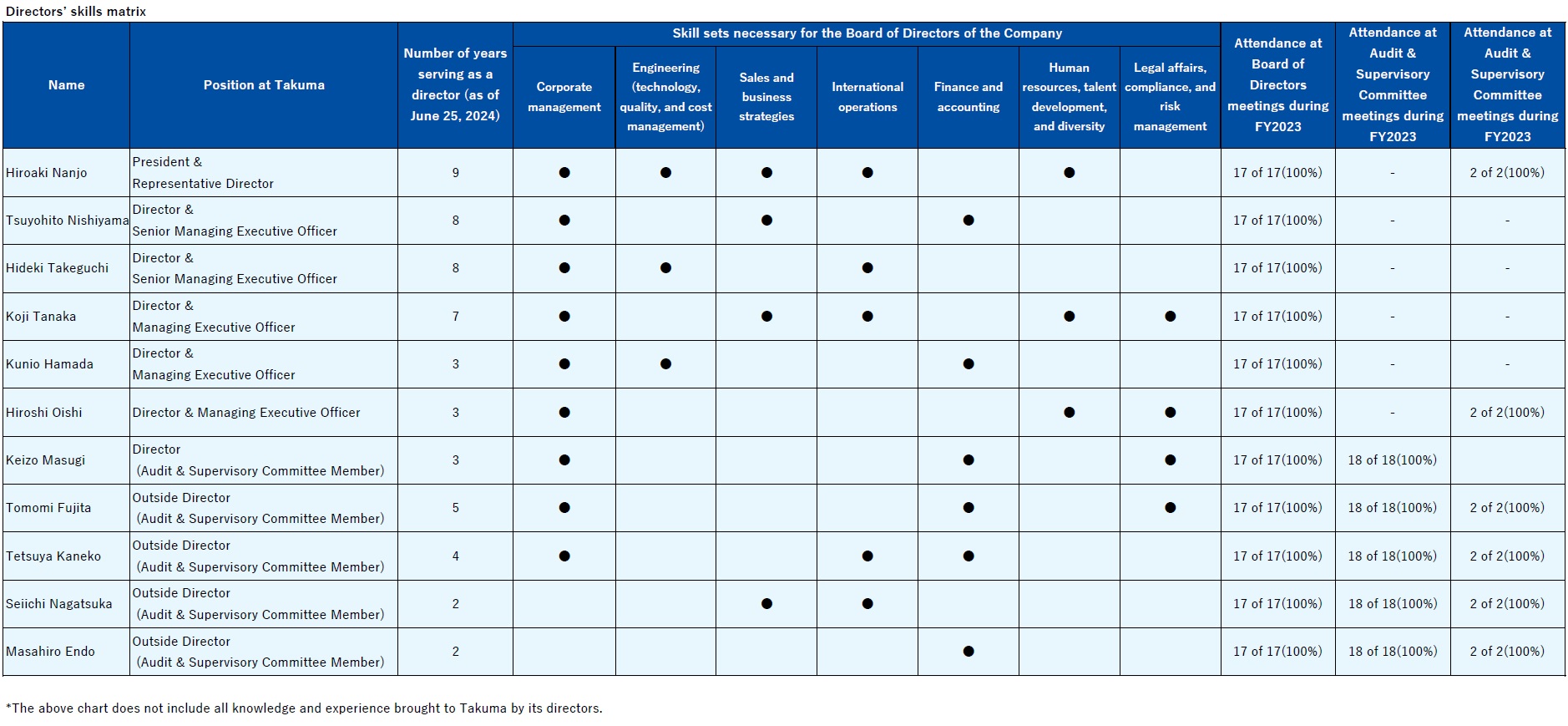

To maintain an appropriate number of members who can conduct effective discussions and assure that the body can appropriately carry out its role of decision-making on basic policies and important matters related to the company's management and supervision of directors’ and executive officers’ execution of their job responsibilities, Takuma takes various steps to ensure that the Board of Directors’ membership exhibits a good balance of knowledge, experience, and ability. The Policy on the Appointment and Dismissal of Executives put in place by the Board of Directors establishes appropriate processes for appointing and dismissing executives along with basic requirements for director candidates and executive officers; criteria for appointing director candidates, executive officers, and other positions; and criteria for dismissing directors and executive officers.

The Nominating & Compensation Advisory Committee, whose membership consists of independent officers, representative directors, and the officer in charge of human resources (with a majority of independent outside directors), discusses the appointment and dismissal of directors and executive officers, including the position of president and CEO, in accordance with the Policy on the Appointment and Dismissal of Executives put in place by the Board of Directors. The Board of Directors makes final decisions in such matters after sufficient discussion based on factors including directors’ past and present performance of their responsibilities while respecting reports and advice from the Committee.

Takuma designates all outside executives who satisfy certain qualifications as independent executives.

We assess the independence of outside directors based on standards of independence adopted by the Tokyo Stock Exchange as well as our own internal Standards for Determining the Independence of Outside Executives.

In Takuma's view, the following individuals do not exhibit sufficient independence to qualify as an independent executive:

*1: “Individuals/entities whose principal business partner is Takuma” refers to individuals and entities that earned at least 2% of their consolidated net sales during the most recent business year from Takuma.

*2: “officers” refers to managing directors, executive officers, and other personnel.

*3: “Principal business partners of Takuma” refers to individuals and entities whose payments to Takuma constituted at least 2% of Takuma's consolidated net sales during the most recent business year.

*4: “A certain amount” refers to at least JPY 10 million (for individuals) or at least 2% of gross sales (for organizations) during the most recent business year.

*5: “Major shareholder” refers to an individual or entity that holds at least 10% of the total voting rights.

In order to increase the effectiveness of the Board of Directors, all directors participate in a questionnaire and interviews about the body’s effectiveness once a year. Those results are then analyzed, evaluated, reported to the Board by the executive in charge of the evaluation process, and discussed by the Board.

In the FY2022 evaluation, the effectiveness of the Board of Directors was analyzed and evaluated from five perspectives: the body’s composition, its operation, the responsibilities of its members, its overall effectiveness, and the operation of the Nominating & Compensation Advisory Committee, which was established with the goal of enhancing the Board’s oversight function. This evaluation found that the Board had operated in an effective and efficient manner and that it was implementing ongoing initiatives to improve its functionality and ensure its effectiveness, for example by placing discussions on strategic themes from a medium- and long-term perspective and progress reports on the agenda for Board meetings. At the same time, recognizing that the evaluation identified the need to ensure sufficient time for participants to review materials explaining proposed resolutions in advance, the Board will work to further boost its effectiveness by taking action such as distributing some materials earlier than in the past.

Meeting on June 28, 2016, the 112th Annual General Meeting of Shareholders resolved to limit compensation and other remuneration paid to directors (except Audit & Supervisory Committee members) to JPY 350 million per year. When the Annual General Meeting of Shareholders in question ended, there were six directors (not counting Audit & Supervisory Committee members).

Meeting on June 26, 2019, the 115th Annual General Meeting of Shareholders resolved to pay monetary compensation rights not greater than JPY 90 million per year to directors (except Audit & Supervisory Committee members) for use in acquiring restricted stock, separate from the above compensation limit. (The resolution limited the total number of shares of Takuma common stock issued or disposed for this purpose to 120,000 shares per year.) When the Annual General Meeting of Shareholders in question ended, there were six directors (not counting Audit & Supervisory Committee members).

Meeting on June 28, 2016, the 112th Annual General Meeting of Shareholders resolved to limit compensation and remuneration paid to directors who are members of the Audit & Supervisory Committee to JPY 72 million per year. When the Annual General Meeting of Shareholders in question ended, there were four directors that were members of the Audit & Supervisory Committee.

Takuma's Policy on Executive Compensation and Other Remuneration, which was established by resolution of the Board of Directors, codifies Takuma's policies for determining compensation and other remuneration for directors (except Audit & Supervisory Committee members). The policy is revised as necessary by resolution of the Board of Directors following consultation with, and consideration of recommendations submitted by, the Nominating & Compensation Advisory Committee.

Takuma has adopted the following basic policies concerning the determination of compensation:

| Compensation system | details | ||

|---|---|---|---|

| Compensation system | Fixed compensation | details | Fixed compensation is set depending on the role and responsibilities of each position and paid on a monthly basis. |

| Compensation system | Bonuses | details | Takuma has adopted a set of standards for calculating bonuses based on indicators such as fiscal year performance and achievement of targets, and the Board of Directors determines whether to pay bonuses and, if so, in what amount using those standards as a guide. Bonuses are paid at predetermined times each year. As a general rule, bonuses are capped at a maximum of 25% of fixed salary (annual amount). |

| Compensation system | Stock compensation | details | Stock compensation takes the form of shares of restricted stock that are granted in advance. Monetary compensation rights set depending on the role and responsibilities of each position are allocated at predetermined times each year, and shares in Takuma are granted in exchange for the pay-in of those rights. The ratio of stock compensation to fixed compensation (annual amount) shall be a maximum of 30%, with the ratio increasing for more senior positions. |

The Nominating & Compensation Advisory Committee, whose membership consists of independent officers, representative directors, and the officer in charge of human resources (with a majority of independent outside directors), discusses matters related to compensation and remuneration programs, the amount or calculation standard for each director’s compensation and other remuneration, and other executive officers’ compensation and other remuneration in accordance with the Policy on Executive Compensation and Other Remuneration and reports the results to the Board of Directors. Having received that report, the Board of Directors makes final decisions on related matters after sufficient discussion while respecting the Committee's report.

In determining the amounts of individual compensation packages, the suitability of those packages is verified based on factors including the Group's performance, compensation levels for executives at other companies, and employee salary levels.

Compensation for directors who are Audit & Supervisory Committee members and related issues are determined through discussion of directors who are Audit & Supervisory Committee members, within the scope set forth by the General Meeting of Shareholders.

Because the Group's business operates primarily on a build-to-order basis and because it considers consolidated ordinary profit to be the most important management indicator, consolidated order value and consolidated ordinary profit serve as key performance indicators in calculating bonuses that are based on fiscal year performance.

Specifically, a calculation table is used to calculate a coefficient based on the consolidated ordinary profit for the business year in question, the rate of growth relative to the average consolidated ordinary profit for the most recent three years, the extent to which the consolidated ordinary profit target has been achieved, and the extent to which the consolidated order value target has been achieved. Bonus amounts are then determined based on this coefficient. (Consolidated ordinary profit performance figures are calculated before deducting executive bonuses at companies included in consolidated accounting.) Performance forecasts included in the financial briefing announced in May are used as target values in the evaluation.

Takuma offers directors stock compensation in the form of shares of restricted stock as a medium- and long-term incentive and as a means of sharing shareholder value. Transfer is restricted for a period of 30 years from the date on which the allocation of Takuma common stock is made, and the restriction is removed when that period ends or if the individual in question passes away, completes his or her term, retires, or otherwise ends his or her involvement with the company before the period ends for a legitimate reason approved in advance by the Board of Directors.

| Executive category | Total compensation and other remuneration (millions of yen) | Total compensation and other remuneration by type (millions of yen) | Number of executives included | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Basic compensation | Performance-linked compensation and other remuneration | Non-monetary compensation and other remuneration | ||||||||||||

| Executive category | Director (except Audit & Supervisory Committee member) | Total compensation and other remuneration (millions of yen) | 260 | Total compensation and other remuneration by type (millions of yen) | Basic compensation | 183 | Total compensation and other remuneration by type (millions of yen) | Performance-linked compensation and other remuneration | 36 | Total compensation and other remuneration by type (millions of yen) | Non-monetary compensation and other remuneration | 40 | Number of executives included | 8 |

| Executive category | Director (Audit & Supervisory Committee member) (outside director) |

Total compensation and other remuneration (millions of yen) | 56 (35) | Total compensation and other remuneration by type (millions of yen) | Basic compensation | 56 (35) | Total compensation and other remuneration by type (millions of yen) | Performance-linked compensation and other remuneration | - | Total compensation and other remuneration by type (millions of yen) | Non-monetary compensation and other remuneration | - | Number of executives included | 6 (4) |

*Performance-linked compensation and other remuneration consists of bonuses awarded to directors (except Audit & Supervisory Committee members).

*Non-monetary compensation and other remuneration consists of shares of restricted stock granted to directors (except Audit & Supervisory Committee members).

Internal audits of Takuma and its group companies are carried out by the Internal Audit Department, a specialized auditing department positioned independently from operational departments that reports directly to the president. The Department evaluates the implementation and operation of internal controls based on applicable laws, the Articles of Incorporation, internal rules, and other guidelines and determines whether operations are being carried out in an appropriate and efficient manner.

Internal audits are carried out in accordance with the Internal Audit Department Activity Policies and the Annual Audit Plan. During FY2022, the following aspects of operations, which were identified in the Audit Plan, were reviewed on a priority basis:

Compliance with rules governing decision-making authority, other internal rules, and applicable laws and regulations

Status of execution of management activities and risk management, as well as the study, evaluation, and support for efficiency

Status of management of documents, forms, and internal documents

Suitability of contract-related documents and accounting evidence

Status of the maintenance and operation of internal controls from the above standpoint and follow-up on previously identified issues (implemented in a particularly high-priority manner for group companies)

Review of implementation status for personnel assignments and education/training

Action taken in response to CSR Awareness Survey results

Materiality (key issues) in ESG management and KPI achievement

The results of each internal audit are summarized in an internal audit report, whose contents are reported to the president and Audit & Supervisory Committee members before being distributed to involved departments. In the event improvements, corrective measures, or other action is necessary, that information is included in the internal audit report, which is then distributed to involved departments once it has been approved by the president, at which point it comprises instructions for various actions to be taken. Departments receiving these instructions undertake the directed actions without delay and report on the viability of their implementation along with improvement plans and information about the status of measures taken to the president via the Internal Audit Department in the form of a Measure Response Form.

The following information relating to compliance with standards of conduct and ethics is audited:

FY2023 is the final year of the 13th Medium-Term Management Plan (FY2021 to FY2023).

The world changed dramatically during FY2021 and FY2022 due to the COVID-19 pandemic and geopolitical developments including the crisis between Russia and Ukraine, but Takuma managed to listen seriously to its customers and steadily advance its business despite those challenges.

In addition, as the importance of initiatives addressing climate change, human capital, and diversity grows as part of a trend highlighted by the mandatory inclusion of sustainability disclosures in financial reports starting in FY2023, Takuma is actively tackling priorities in those areas in keeping with its Company Motto of “Value Technology, Value People, Value the Earth”.

This fiscal year, we will continue to advance our businesses while resolving a variety of challenges as we work to achieve the goals set forth in the 13th Medium-Term Management Plan.

I believe that having an effective Board of Directors is an essential prerequisite in order to advance the company’s business while operating it in an appropriate manner, and I am happy to report that Takuma’s Board of Directors, which is comprised of people representing a variety of backgrounds, fosters animated discussions.

Evaluations of the Board’s effectiveness and other tools have established that we are playing the functions expected of us, even as we strive to become a more effectively body.

I look forward to helping increase Takuma’s corporate value by fulfilling my role as an outside director.

When I became an outside director in 2020, the COVID-19 pandemic had just begun, with the result that many meetings were held online, and it was impossible for me to visit various sites as I had planned. Fortunately, I was able to deepen my understanding of the company during FY2022 as the number of real, in-person meetings grew, and I was able to visit some of the company’s sites.

In particular, those site visits allowed me to come into direct contact with Takuma’s extensive technological capabilities and dynamic energy, and I was also able to listen directly to some of the challenges faced by those sites. I feel that as I draw on the knowledge gained from site visits while participating in discussions by the Board of Directors and other bodies, I am able to offer frank opinions concerning the company’s overall direction, the issues with which it is grappling, and the solutions being undertaken in a way that is consistent with my understanding of its worksites.

As the importance of the ESG perspective grows, I look forward to continuing to pour all my energy into thinking about how Takuma’s technology can contribute most effectively and how it can increase the magnitude of that contribution. It may be necessary to promote Takuma’s contribution to resolving environmental issues more assertively.

With the new TAKUMA Building (Training Center) opening, construction of the new Harima Factory reaching completion, and the number of mid-career hires growing, we are also focusing on bolstering Takuma’s human resources. As we pursue numerous long-term projects, the benefits of those efforts will not appear in the company’s performance numbers overnight, but I believe that the mission we have been given is to explore how we can leverage these investments most effectively so that they function to augment medium- and long-term growth. And I feel that Takuma has the ability to do that.

I feel deeply honored to have been appointed to serve as an outside director at Takuma.

While working as a public servant for more than 32 years at the Ministry of Economy, Trade and Industry, I gained a range of governmental experience, including being seconded to an overseas diplomatic mission, local government agency, and independent administrative agency. After retiring from the Ministry, I was involved with programs designed to facilitate the development of the automotive industry while serving for about eight years as a representative director of a general incorporated association. I look forward to drawing on my experience in the public sector and on my knowledge of corporate support to contribute to Takuma’s development.

Japanese industry is being called upon to respond quickly to a dramatic transformation accompanying changes in the structure of society, including carbon neutrality and the digital transformation. At the same time, globalization makes it necessary to practice sophisticated risk management to address the immediate manifestation of business risk posed by overseas events, including the spreading COVID-19 pandemic and the crisis in Ukraine. One might say that the business environment in which companies operate is rapidly becoming more challenging.

Takuma has led with meaningful businesses, for example by supplying infrastructure that plays an essential role in addressing environmental and energy issues, while leveraging technologies developed over many years in keeping with its founding spirit of contributing to society through boilers. In the future, I believe that increasing its corporate value in a sustained manner as a leading company by practicing ESG management in accordance with the Vision 2030 long-term vision is both Takuma’s role in society and the fulfillment of stakeholders’ expectations.

I look forward to doing my best to ensure I understand Takuma’s businesses and to cooperate with other outside directors to contribute to the company’s development.

I am Masahiro Endo, and I am a certified public accountant who now serves as an outside director and member of the Audit & Supervisory Committee. After being approached to serve in this position, I reviewed publicly available materials (financial statements, timely disclosures, etc.) to learn Takuma’s stance on governance and compliance. I was able to affirm that the company’s governance structures are appropriate for a company listed in the Prime Market, allowing me to accept the appointment with peace of mind. In addition, Takuma technologies in areas such as waste and water treatment align closely with the SDGs with which society is grappling, and I believe that the sustained growth of Takuma itself embodies a contribution to society. As a result, I have high expectations for the company’s future.

As for what the company expects of me, the Audit & Supervisory Committee is a group effort, so the body must carry out organizational audits in a way that draws on the expertise of each of its members. I understand that in addition to taking advantage of my specialty as a certified public accountant, I will need to update my knowledge as an Audit & Supervisory Committee member.

I believe that the significance of the “outside” in “outside director” lies in helping put in place an environment that supports appropriate risk-taking. I look forward to working to meet the expectations of stakeholders, particularly shareholders, by supervising operations while offering advice and leveraging that outside perspective to judge risks accompanying the company’s decision-making, verify the methods by which that risk can be reduced or avoided, and continually ask myself whether risk-taking falls within allowable limits.