Vision 2030, our long-term vision for the Takuma Group 10 years in the future, includes this statement: “Aim to maintain our role of being an indispensable presence in society as a leading company in the field of renewable energy utilization and environmental protection by realizing sustained growth alongside our customers and society through implementation of ESG management.” Reflecting the agreement between the direction we seek to pursue in our businesses and the general thrust of social pressure to reduce greenhouse gas emissions and increase the resilience of infrastructure in the face of intensifying natural disasters, we identified “helping combat climate change” as one issue that deserves to be addressed on a priority basis (Materiality), and we announced our support for the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD) in April 2022. As the Group works to realize its corporate vision, we will strive to enhance initiatives that help realize a sustainable society by resolving issues faced by customers and society through the provision of products and services and by reducing our own CO2 emissions. In addition, we will work to increase the sophistication of our approach to climate change and of our information disclosure initiatives through dialog with stakeholders.

We consider contributing to measures addressing climate change to be an important management priority, and we are pursuing a series of companywide initiatives under monitoring structures put in place by our Board of Directors. The Executive Manager, Corporate Planning & Administration Division (secretariat: Planning Department), who serves as the executive in charge of dealing with climate change, requests or instructs involved departments to cooperate, gathers information about how climate change will impact our businesses as well as associated initiatives, evaluates the risks and opportunities posed by climate change, and reviews the status of related initiatives. This information is then reviewed by the Environment Committee (chairman: Executive Manager, Compliance & CSR Promotion Division) and reported to the Board of Directors following discussion by the Committee of Executive Officers as necessary. The Board of Directors supervises the status of Takuma’s initiatives related to measures addressing climate change through these reports as well as their consistency with the company's business policies (in principle, once a year), and the Board reviews policies as necessary and determines strategy.

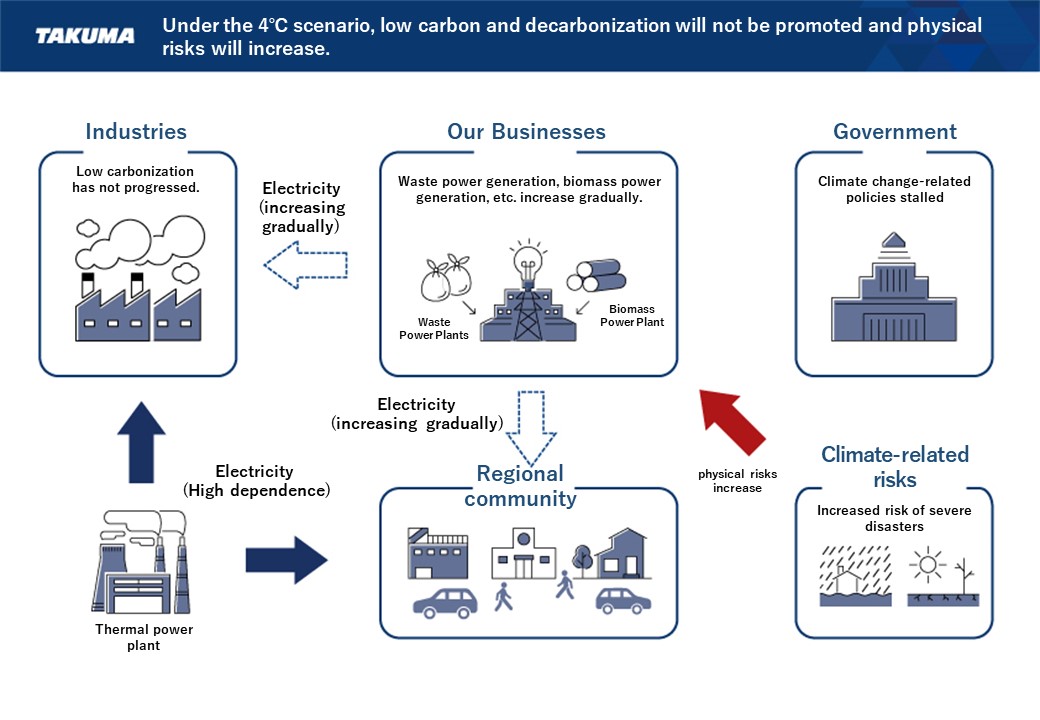

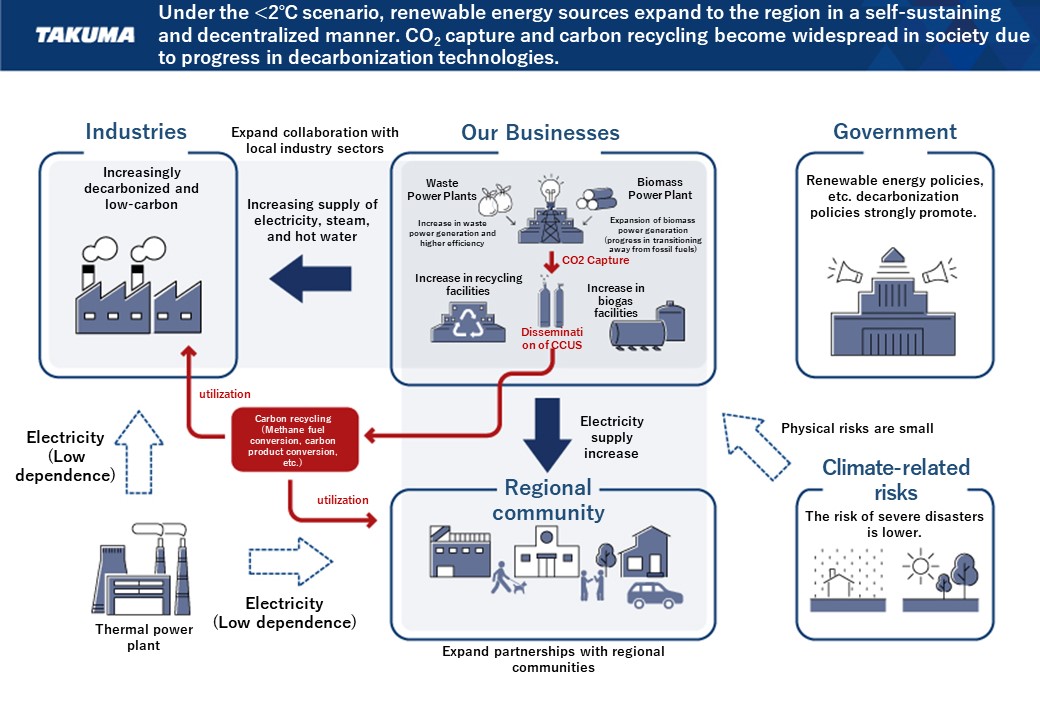

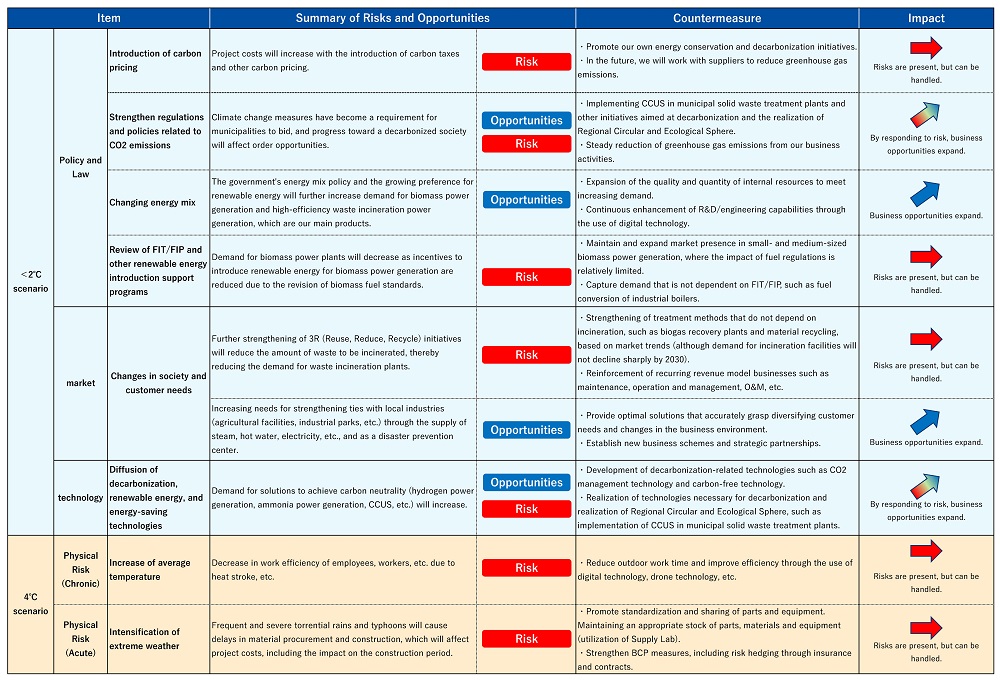

After taking into account multiple scenarios announced by the Intergovernmental Panel on Climate Change (IPCC) and International Energy Agency (IEA), and referring to various materials released by the Ministry of Economy, Trade and Industry and the Ministry of the Environment, we established the two scenarios described below (one assuming a temperature rise of less than 2°C, and the other a rise of 4°C). We then analyzed the two scenarios with a focus on our Domestic Environment and Energy Business, a flagship business that accounts for the majority of the Group’s sales and a segment of our operations that is likely to be affected by climate change. We conducted this analysis through 2030, the final year of Vision 2030, our long-term vision, in an effort to identify the risks and opportunities that climate change would pose for our operations and to summarize the measures that we could undertake to resolve associated issues.

| Established scenario | Overview | Reference scenario(s) | |||

|---|---|---|---|---|---|

| Established scenario | <2°C scenario | Overview | A scenario in which progress in decarbonization restrains the average worldwide temperature increase to less than 2°C, as set forth in the Paris Agreement | Reference scenario(s) | NZE, SDS, and APS (IEA); RCP 2.6 (IPCC) |

| Established scenario | 4°C scenario | Overview | A scenario in which a lack of progress in decarbonization results in an average worldwide temperature increase of 4°C or greater | Reference scenario(s) | RCP 8.5 (IPCC) |

Note

NZE: Net Zero Emissions Scenario; SDS: Sustainable Development Scenario; APS: Announced Pledges Scenario; RCP: Representative Concentration Pathways Scenario

We identified key risks and opportunities after extracting risks and opportunities posed by climate change from the standpoint of all value chains in the analyzed businesses, including sales, engineering, procurement, and construction, and evaluating them using a three-tier scale based on the extent of their impact on those businesses. As a result of our scenario analysis, we confirmed that there are no changes from the risks and opportunities identified in FY2023 and that there are no new risks or opportunities related to changes in strategy.

Under the <2°C scenario, changes in the energy mix and growing energy-saving awareness combine to drive up demand for flagship products like biomass power and waste incineration power plants, while partnerships between our plants and local industry (agricultural facilities, industrial parks, etc.) are strengthened through our provision of steam, hot water, electricity, and other forms of energy. Set against this expected expansion of opportunities for our businesses are a number of anticipated migration risks, including a reduction in new and replacement demand for waste incineration plants due to stepped-up implementation of the 3Rs (reduce, reuse, and recycle) and accommodation of new needs such as CO2 capture, utilization, and storage (CCUS). To accommodate these developments, we will look to mitigate risks while taking advantage of opportunities to expand our businesses, including by proposing optimal solutions to individual customers; enhancing recurring revenue model businesses like maintenance, operation management, and O&M; strengthening product groups that do not rely on incineration, for example biogas recovery plants and recycling plants; and continuing R&D geared to realizing carbon neutrality, for example in the area of CCUS.

Under the 4°C scenario, frequent and intensifying abnormal weather lead to delays in material procurement and construction, posing potential impacts on business costs, including in the form of schedule impacts. In response, we will work to standardize parts and equipment; to optimize stocks of parts, materials, and equipment at Supply Lab (after-sales service facilities); and to strengthen business continuity planning, for example by establishing sufficient risk buffers and hedging risks through insurance agreements.

In addition, the 14th Medium-Term Management Plan incorporates a strategy through FY2026 that looks toward 2030.

At the instruction of the Executive Manager of the Corporate Planning & Administration Division (secretariat: Planning Department), who serves as the executive in charge of dealing with climate change, a regular (in principle, once each year) review of risks and opportunities with the potential to have a major impact on our management and finances was undertaken, and the results of the associated evaluation and analysis were reported to the Board of Directors after being reviewed by the Environment Committee. The Board of Directors is supervising the status of our initiatives related to climate change through this report. We have put in place companywide risk management structures based on our Risk Management Code, and we have established a risk management team (in the form of the Compliance & CSR Promotion Division) to identify, avoid, transfer, mitigating, and otherwise address risks with the potential to negatively impact our businesses. The Legal Affairs & CSR Department supervises the Environment Committee's secretariat in assessing climate change risk and reviewing the status of initiatives to address it.

As we look to realize carbon neutrality by 2050 as well as Vision 2030, our long-term vision, we will work to resolve customer and societal issues by supplying products and services that contribute to energy conservation and decarbonization while reducing our own CO2 emissions.

*Possible reductions in CO2 emissions from newly delivered power plants (biomass and waste power plants delivered from FY2021 to FY2030)

*Calculated based on the renewable portion of available generating capacity starting during the month after delivery for plants delivered from FY2021 to FY2024.

(Seven Energy from Waste plants, two sewage sludge incineration power plant, 21 biomass and other power plants)

Note 1: The target includes offsets using environmental value such as J-credits.

Note 2: The Scope 2 target is calculated using post-adjustment emission factors.

Note 3: Takuma domestic worksites : Head Office, branch companies, branches, factories, and construction sites

Note 4: FY2030 targets including group companies remain under consideration.

Note 5: CO2 emissions from procured products and use of Takuma products by customers (Scope 3) also remain under consideration.

The total Scope 1 and Scope 2 CO2 emissions were 64 t-CO2 at the Takuma Head Office, branch companies, branches and Harima Factory, including offsets based on environmental value for fiscal 2024; they were 478 t-CO2 before offsets.

| Head office ① |

Harima factory ② |

branch companies, branches ③ |

construction sites (no data) |

total (①+②+③) |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| FY2023 | Scope1 | Head office ① |

240 | Harima factory ② |

168 | branch companies, branches ③ |

4 | construction sites (no data) |

- | total (①+②+③) |

412 |

| Of which, credit purchased | Head office ① |

240 | Harima factory ② |

168 | branch companies, branches ③ |

4 | construction sites (no data) |

- | total (①+②+③) |

412 | |

| Scope2 | Head office ① |

0 | Harima factory ② |

0 | branch companies, branches ③ |

188 | construction sites (no data) |

- | total (①+②+③) |

188 | |

| total (Scope1+Scope2) |

Head office ① |

240 | Harima factory ② |

168 | branch companies, branches ③ |

193 | construction sites (no data) |

- | total (①+②+③) |

601 | |

| total (Subtract credit purchases) |

Head office ① |

0 | Harima factory ② |

0 | branch companies, branches ③ |

188 | construction sites (no data) |

- | total (①+②+③) |

188 | |

| FY2024 | Scope1 | Head office ① |

254 | Harima factory ② |

154 | branch companies, branches ③ |

4 | construction sites (no data) |

- | total (①+②+③) |

413 |

| Of which, credit purchased | Head office ① |

254 | Harima factory ② |

154 | branch companies, branches ③ |

4 | construction sites (no data) |

- | total (①+②+③) |

413 | |

| Scope2 | Head office ① |

0 | Harima factory ② |

0 | branch companies, branches ③ |

64 | construction sites (no data) |

- | total (①+②+③) |

64 | |

| total (Scope1+Scope2) |

Head office ① |

254 | Harima factory ② |

154 | branch companies, branches ③ |

69 | construction sites (no data) |

- | total (①+②+③) |

478 | |

| total | Head office ① |

0 | Harima factory ② |

0 | branch companies, branches ③ |

64 | construction sites (no data) |

- | total (①+②+③) |

64 |

Note 1: Totals may not add up due to fractional processing.

Note 2: As of April 2022, all electricity used at the Head Office and Harima Factory had been replaced with non-fossil electricity derived from renewable energy.

Note 3: Purchase J-credits equivalent to Scope 1 emissions.

We have started calculating fuel consumption for CO2 emissions at construction sites from fiscal 2025. We will continue to work on expanding the scope of disclosure.

During the period of the 14th medium-term management plan, we will study how to estimate CO2 emissions for Scope 3 of the highly important target scope and how to set KPIs that include group companies.